While using a mobile banking app, you also want to be sure that your financial transactions are safe and secure. And, of course, you want to access the best banking features possible. With multiple aspects to consider, one thing is for sure – you will need the best mobile money transfer app to get the job done. On that note, here are 4 must-have features you should look for in your next mobile money transfer app –

-

User-friendly interface and dashboard

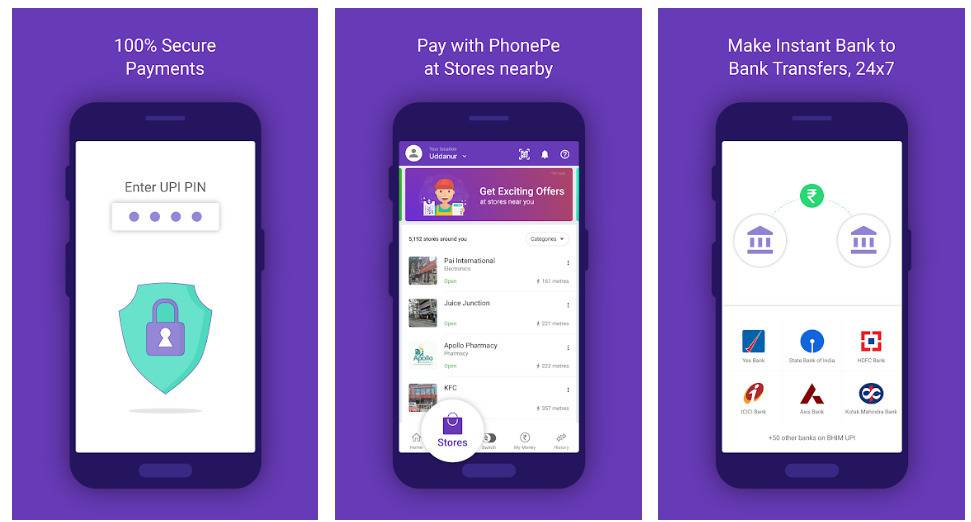

The last thing you would want is to waste time trying to figure out how to use the app. So, a good mobile money transfer app should have a simple yet effective interface with clear instructions. Its dashboard should be user-friendly and easy to navigate. It should provide all the essential features like check account details, debit/credit card details, money transfers, previous transactions, scheduled transactions, open online bank account etc., at your fingertips.

-

Essential banking features/services in one place

The best mobile money transfer app must offer features that facilitate easy money transfers and financial management. IDFC FIRST Bank mobile banking app, for example, offers useful banking features such as adding funds instantly from any account, UPI, NEFT, IMPS, and RTGS payment options, viewing your balance/transactions and managing your ‘upcoming’ spends with just a few taps. If you have any queries, you can easily contact customer service directly through the app.

Click here – How to Choose Tech Stack for Developing a Travel App?

-

Investment options in different financial instruments

The best mobile money transfer app should allow you to invest in various types of investment options such as mutual funds, stocks, and bonds. This will give you the opportunity to grow your money over time and make the most of your financial resources. For example, with IDFC FIRST Bank mobile banking app, you can start investing in mutual funds with as little as Rs. 500 per month through SIPs (systematic investment plans). And if you want to open a fixed deposit account, you can do so in just 2 minutes. Note that the best bank for personal banking should offer such features in its money transfer app.

-

Auto pay feature

A lot of people are unaware of the fact that paying their bills on time can actually help to improve their credit score. The same is true for loan EMIs and other financial obligations. This is why the best mobile money transfer app should have an auto-pay feature which can automatically process the payment on the specified date, ensuring that bills are always paid on time. Since making on-time payments can improve your credit score, you can then go on to access more attractive interest rates on loans. The auto-pay feature can also be used to make recurring payments.

The best mobile money transfer app will offer features that can make the process of transferring money easier, faster, and more convenient. Most importantly, the mobile application for your bank account must offer security features like biometrics (fingerprint or face recognition) and two-factor authentication for safe login and secure transactions.

Click here – Know The 10 Surprising Causes Of Blood Sugar Fluctuations